child tax credit september 2021

The Child Tax Credit provides money to support American families. The American Rescue Plan in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a 600 bonus for kids under the age.

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

The credit is not a loan.

. For each qualifying child age 5 and younger up to 1800 half the total will come in. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Parents of about 60 million children will receive direct deposit payments on September 15 while some may receive the checks through the mail anywhere from a few days to a week later.

The full amount of the child tax credit for 2021 is refundable. IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. Children who are adopted can.

The 500 nonrefundable Credit for Other Dependents amount has not changed. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Unlike in previous years the new credit also allows families with extremely low or no income to qualify for the entire benefit.

That comes out to 300 per month through the end of 2021 and. 3600 for children ages 5 and under at the end of 2021. That depends on your household income and family size.

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. The first half of the credit will be sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when filing taxes for 2021. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

The remaining 2021 child tax credit payments will be. 3600 for children ages 5 and under at the end of 2021. 3000 for children ages 6 through 17 at the end of 2021.

Ad The new advance Child Tax Credit is based on your previously filed tax return. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per. IRS sends third child tax credit payments around 15 billion to 35 million families VIDEO 906 0906 How a couple living in.

The IRS has resolved a technical issue for thousands of families who didnt receive their September child tax credit payment on time. That drops to 3000 for each child ages six through 17. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. IRSnews IRSnews September 18 2021. More than 30million households are set to receive the payments worth up to 300 per child starting September 15.

The advance is 50 of your child tax credit with the rest claimed on next years return. Nearly every family is eligible to receive the 2021 CTC this year including families that havent filed a tax return and families that dont have recent income. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

The first two payments were sent on. Thats up to 7200 for twins This is on top of payments for. This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for.

Qualifying American families will receive up to 3600 per child for the tax year 2021. 15 opt out by Oct. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

September Advance Child Tax Credit Payments. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that started this week. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021.

Children who are adopted can also qualify if theyre US citizens. Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17. So each month through December parents of a younger.

If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. It will also let parents take advantage of any increased payments they. Here is some important information to understand about this years Child Tax Credit.

Child Tax Credit 2021 8 Things You Need To Know District Capital

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit Publications Columbia University Center On Poverty And Social Policy

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

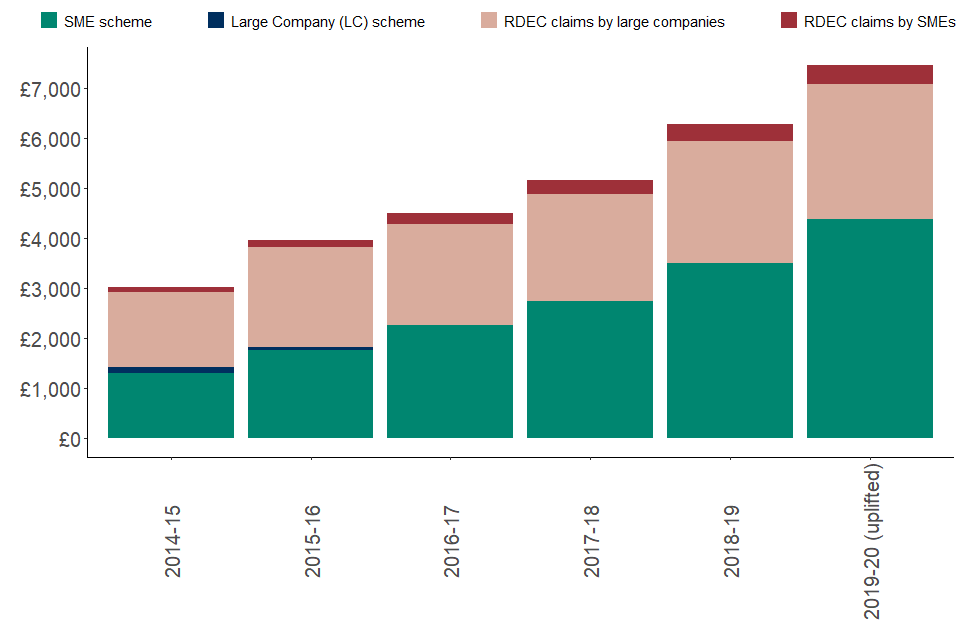

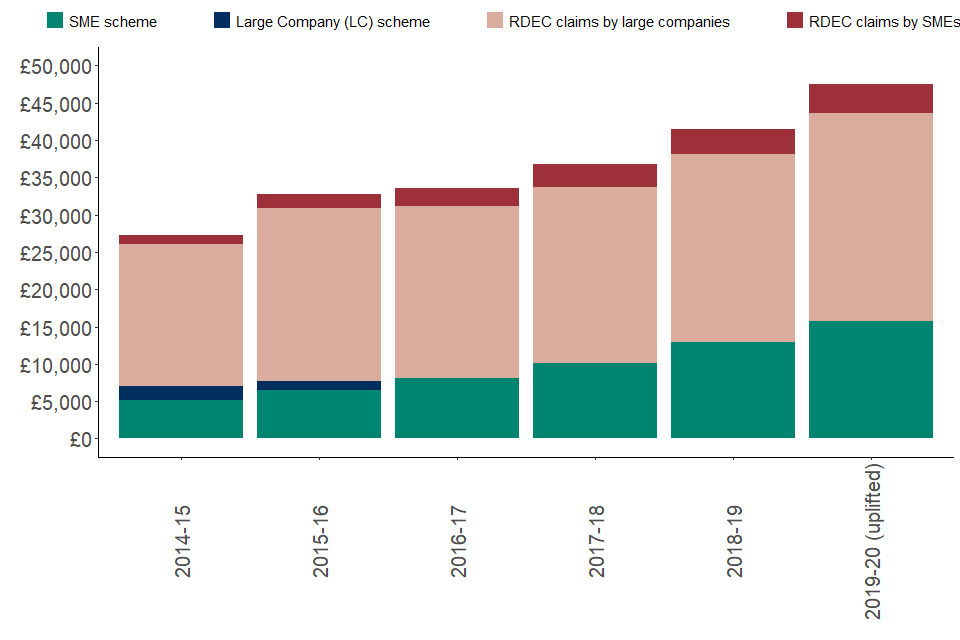

Research And Development Tax Credits Statistics September 2021 Gov Uk

Research And Development Tax Credits Statistics September 2021 Gov Uk

Tax Credits Payment Dates 2022 Easter Christmas New Year

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Child Tax Credit Schedule How Many More Payments Are To Come Marca

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit 2021 8 Things You Need To Know District Capital